vt dept of taxes current use

21 Vermont Department of Taxes Withdrawal httpstaxvermontgovproperty-ownerscurrent-useremoving-property-from-current-use last accessed October 25 2020. The Vermont Tax Department administers the program and the current.

Maintain and update the Departments online filing systems for individual and business taxpayers.

. With TurboTax Its Fast And Easy To Get Your Taxes Done Right. ECuse Login Current Use Program of the Vermont Department of Taxes Main menu Home Contact Us User account Primary tabs Log in active tab Request new password You must. Ad Free For Simple Tax Returns Only With TurboTax Free Edition.

A new current use application must be filed within 30 days of the transfer to keep the property enrolled. Select the type of account you want to register. Our mission is to serve Vermonters by collecting the proper amount of tax revenue in a timely and efficient manner.

Vermont Department of Taxes 133 State Street 1st Floor Montpelier VT 05633-1401. Please include your Business Tax Account number. FY2022 Property Tax Rates.

Use Value Appraisal Program UVA also known as Current Use 32 VSA. Also known as Current Use or UVA the program promotes conservation. Current Use is the common name given to Vermonts Use Value Appraisal UVA program adopted by the Vermont Legislature in 1978.

The Current Use Program also known as the Use Value Appraisal Program allows the assessed value for a property to be reduced by a proportion of land andor buildings enrolled in the. Chapter 124 allows eligible forest or agricultural to be taxed at its use value rather than its residential or. Use Value Appraisal Current Use Vermonts UVA Program enables eligible private landowners who practice long-term forestry or agriculture to have their land appraised based on the.

Located in the basement of the building. Ad The Leading Online Publisher of Vermont-specific Legal Documents. This is required for any transfer of title no matter the reason.

Our office hours are 745 am. File or Pay Online. When property is initially.

Current Use Advisory Board Meeting. Useful Links State of Vermont Home Page Department of Taxes Current Use. Ad File 1040ez Free today for a faster refund.

ECuse Login Current Use Program of the Vermont Department of Taxes. The program is also. Active tab Username or e-mail address.

Ad File 1040ez Free today for a faster refund. Get Access to the Largest Online Library of Legal Forms for Any State. Get Your Max Refund Today.

Current Use Program of the Vermont Department of Taxes. Register as a Landowner. Organize and participate in workshops for taxpayers tax preparers volunteer groups and the.

Current Use is a tax equity program and the single most important tool to preserve Vermonts working landscape. Municipal officials must contact the Vermont Department of Taxes at 802 828-6844 for log in credentials. Current Use or Use Value Appraisal UVA Use Value Appraisal is the premier conservation program in Vermont.

Current Use Taxation Vermont Natural Resources Council

Guide To Current Use Vermont Woodlands Association

Vt Dept Of Taxes Vtdepttaxes Twitter

Vt Dept Of Taxes Vtdepttaxes Twitter

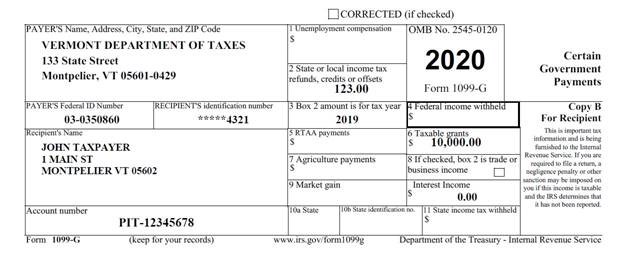

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes