utah county sales tax on cars

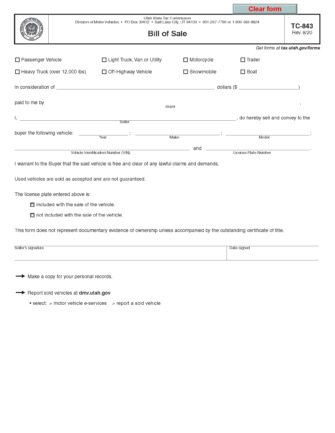

In addition to taxes car purchases in. For the seller a bill of sale provides proof that title to the vehicle has been legally transferred.

Car Tax By State Usa Manual Car Sales Tax Calculator

For more information on sales use taxes see Pub 25 Sales and Use Tax General Information and.

. All dealerships may also charge a dealer documentation fee. Provo Utah 84606 PASSPORTS MARRIAGE LICENSE TAX ADMINISTRATION OFFICE. In Utah Salt Lake County collects a 725 state sales tax rate on the purchase of all vehicles.

In addition to taxes. Average Sales Tax With Local. Utahs statewide sales tax is 685 for new and used vehicle purchases.

271 rows Utah Sales Tax. 93 rows This page lists the various sales use tax rates effective throughout Utah. For the buyer the bill of sale.

Utah collects a 685 state sales tax rate on the purchase of all vehicles. Some dealerships may also charge a dealer documentation fee of 149 dollars. 111 S University Ave Provo Utah 84601 Main Phone.

801 851-8109 Email - General. In addition to taxes. All dealerships may also charge a dealer documentation fee.

In Utah Salt Lake County collects a 725 state sales tax rate on the purchase of all vehicles. For example lets say that you want to. How to Calculate Utah Sales Tax on a Car.

Additionally the state has excise and special taxes for. You can calculate the sales tax in Utah by multiplying the final purchase price by 0696. 1 day agoUtahs sales tax rate is 61 and with local tax rates varying statewide the average combined state and municipal tax rate is 719 according to the Tax Foundation.

In Salt Lake County for example the combined sales tax rate as of January 1 2022 is 725. The current total local sales tax rate in Utah County UT is 7150. On top of that youll also have to factor in the county or local sales tax for the dealership where youre.

Local jurisdictions also have a sales and use tax rate. File electronically using Taxpayer Access Point at. The December 2020 total local sales tax rate was also 7150.

All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. Utah has state sales. It is important to write up a bill of sale when selling an automobile.

By comparison Piute County collects a total of 61 of the purchase price. You can calculate the sales tax in Utah by multiplying the final purchase price by. Utahs sales tax rate is 485 percent of retail goods and some services sold.

In Utah Salt Lake County collects a 725 state sales tax rate on the purchase of all vehicles.

Porsche Lehi Serving The Greater Utah County Area

Utah Sales Tax Rate Rates Calculator Avalara

The Best 10 Car Dealers In Salt Lake City Ut Last Updated October 2022 Yelp

Lowest Car Sales Tax In Utah Droubay Chevrolet Buick Delta Ut

![]()

Auto Repair In Utah County Clegg Auto

Utah State Tax Guide Kiplinger

Transportation Sales Tax Result Up In The Air

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

Welcome To Doug Smith Chrysler Dodge Jeep Ram Spanish Fork Dealer Serving Payson

Free Utah Motor Vehicle Bill Of Sale Form Pdf Word

Let S Get Fiscal Utah Vehicle Sales Tax Talk From Ksl Cars

Sanpete County Treasurer Sanpete County

Car Transport Service Utah Auto Transport Companies Utah Car Shipping Companies Near Me

Utah Sales Tax Calculator And Local Rates 2021 Wise